Incentive Flipping

One of my favorite pet peeves is the incentive misalignment of doctors. In a very simplified format, the problem is doctors make more money the sicker you are and thus they have a perverse incentive that competes against them making you get better.

This incentive misalignment problem is also present in fields like consulting where the consultants get paid more if there are more problems in the company that they can solve, but the doctor problem is the example that I use most of the time to introduce the idea since it’s very starkly visible in that case and most people would have experienced it at some point 1.

Incentive Misalignment Problem 🔗

A more generalized version of incentive misalignment is when you pay money for a service but the outcome of the service is hard to attribute back to the service due to a large number of external variables that can affect it and there is a perverse incentive for the service provider to keep the problem around 2.

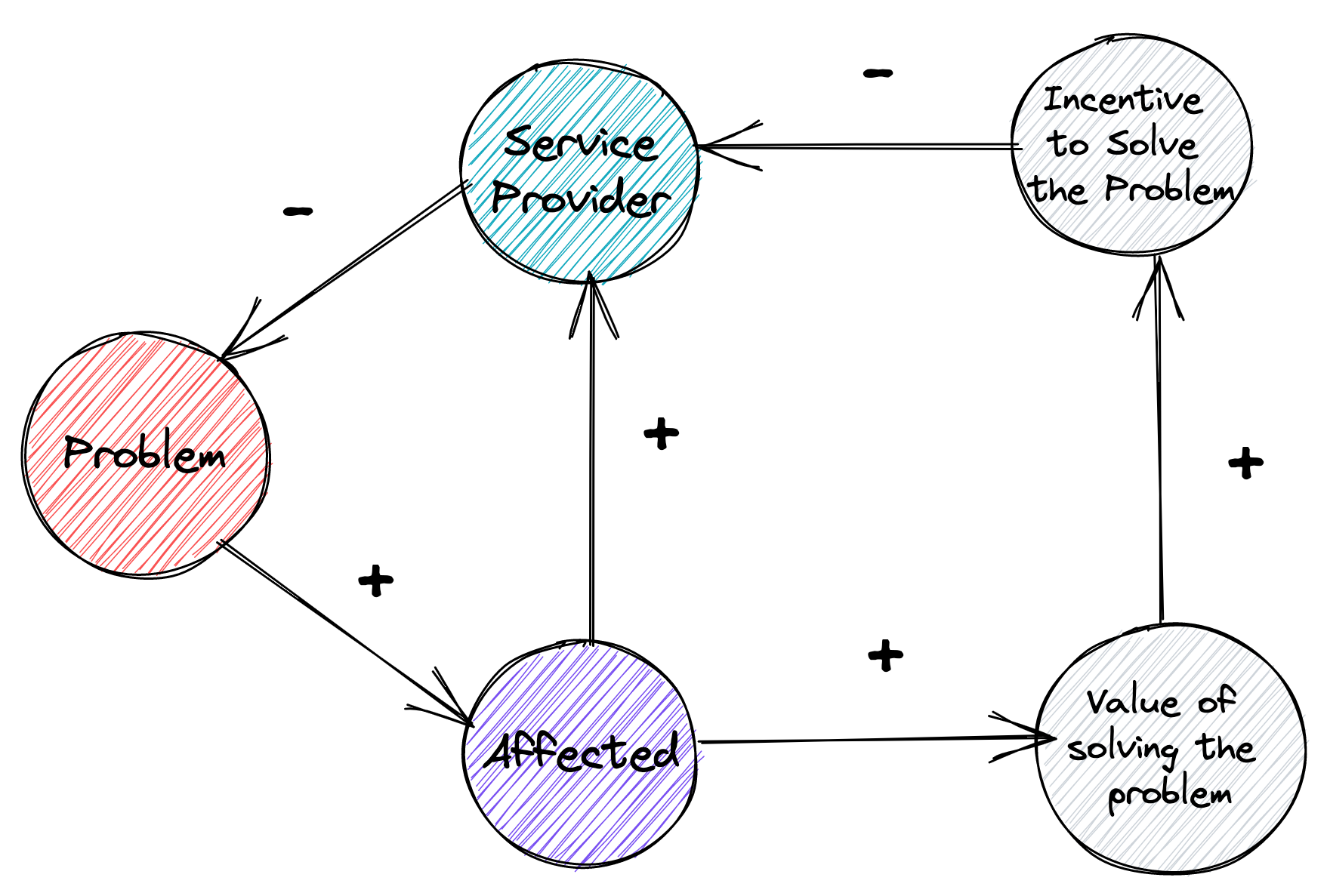

So the system in these cases is set up something like this

In these cases, the affected has to pay high enough to overcome the incentive to keep the problem, which would be much higher than if the incentive was structured to purely solve the problem.

This problem of incentive mismatch bothered me and for a long time, I thought there was no common solution for each of these cases, only specialized solutions in individual cases each of them done via paying a penalty for supervision.

Solving Incentive Misalignments with Futures 🔗

One mechanism for solving these problems in a generalized way is to create futures of these problems and use the standard market mechanisms of shorting and buying them to flip the incentive of these systems.

To illustrate the idea, let’s take the example of doctors and patients again.

Imagine for a moment that you live in perfect market conditions and you were sick, but you were unsure who is the best doctor that can solve your problem. Worse yet, you are also unsure if the doctor you chose will actually solve your problem or falls into the incentive misalignment problem.

In cases like this one option you can pursue is to create a future of your current condition that you can sell to the market.

For the sake of this discussion, let’s say the future you create would be “If I’m still sick (measured by body temperature > +/- 3 degrees of normal healthy body temperature of 36 degrees or something objective) by 5 days from now I will pay $10 to the owner of this future”

Along with this future, you provide basic information that might be helpful for potential market participants. Again assuming perfect market conditions if the price is right for the risk there will be buyers for these futures. Once the future does enter the market it is also not hard to imagine the price of it changing based on the market expectation on if you would be sick or how quickly you would recover etc.

With this done, you now have a financial instrument that when shorted appreciates the quicker you recover and this is exactly what we needed.

Now we can use this and sell the shorts of the future to doctors who then will have an aligned incentive to help you recover. Or even better the interested doctors who believe they can solve your problem more effectively and more efficiently than others can hold short positions in the futures and that would also help you find the best doctor with the most aligned incentive.

Generalized Incentive Flipping Maneuver 🔗

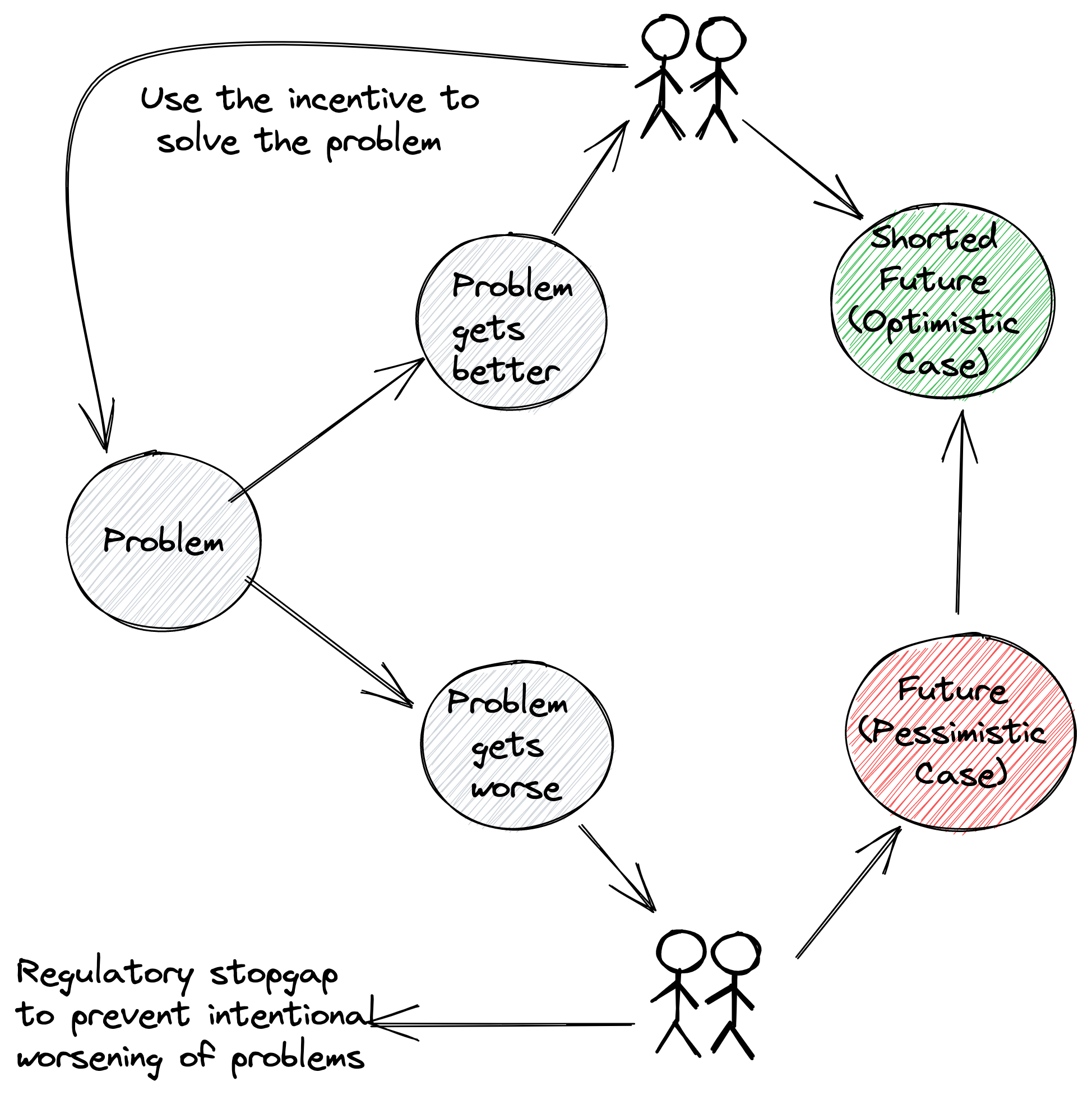

Generalizing from the example, the general version for the incentive flipping maneuver is

- Define a problem

- Create futures that pay off when the problem doesn’t get solved (Usually definable by the consequences if the problem is not solved)

- The people who have the pessimistic viewpoint the problem won’t be solved within the constraints mentioned in the future will buy and trade the futures

- The people who want to solve the problem have an incentive that is backed by the market to solve the problem by shorting the future

It is worth pointing out that this framework needs some regulatory mechanism to ensure the problem is not intentionally made worse by people holding short positions among other things.

Some Applications to Other Fields 🔗

Climate Change 🔗

When I was talking to my friend about this 3, he suggested applying this framework to all hard problems and more specifically to Climate change. That was an extremely prudent recommendation since I was also thinking about climate change for a while but in the context of non-definability of completion of the problem rather than incentive mismatch, but on further thinking it’s clear how the same pattern can be applied for this problem also.

- Create futures of earth not warming more than 2°C in the next 3 decades, let all the climate skeptics put money where their mouth is and buy these futures.

- All the people who are working on solving climate change can short these futures and have an incentive to work on these problems.

Education 🔗

Another field where the same pattern can be applied (to a lesser extent is already being applied) is education. For each degree create futures on the future outcomes of the students (worth noting that the outcomes need not always be defined via cashflow, as long as it can be verified objectively by the market) and let the market buy the pessimistic case of these outcomes and let the org which is teaching these students buy the shorts of that.

Lambda school and other boot camps which take a cut of future revenue of their students are essentially doing a version of the same maneuver.

Apart from aligning incentives to solve the problem, this model also brings legibility to the complexity and value of solving a problem as determined by the market, which I think is useful in its own right.

It goes without saying once these are modeled as securities all the ideas from the securities of bundling, indexing, etc. can be borrowed and a regular market around these can potentially be formed.

There is a lot left out in this article, such as defining objective measurement functions which can be evaluated by the clearinghouse. Nonetheless, I wanted to post this to build on top of this idea by referencing this post in external conversations or other posts.

Obligatory “not all doctors and consultants” ↩︎

See also Shirky Principle. ↩︎

This friend is Chandramouly Kandachar who apart from being a good friend most of the time (with confidence >90%), is also a great sparring partner for weird ideas. (Same person who made me spend so much time thinking about connecting people.) A lot of conversational tactics I use to build arguments with people were created collaboratively while talking with him or were influenced heavily by him. If you are looking for a product manager who can work with weird engineers, hit me up for a warm introduction. ↩︎